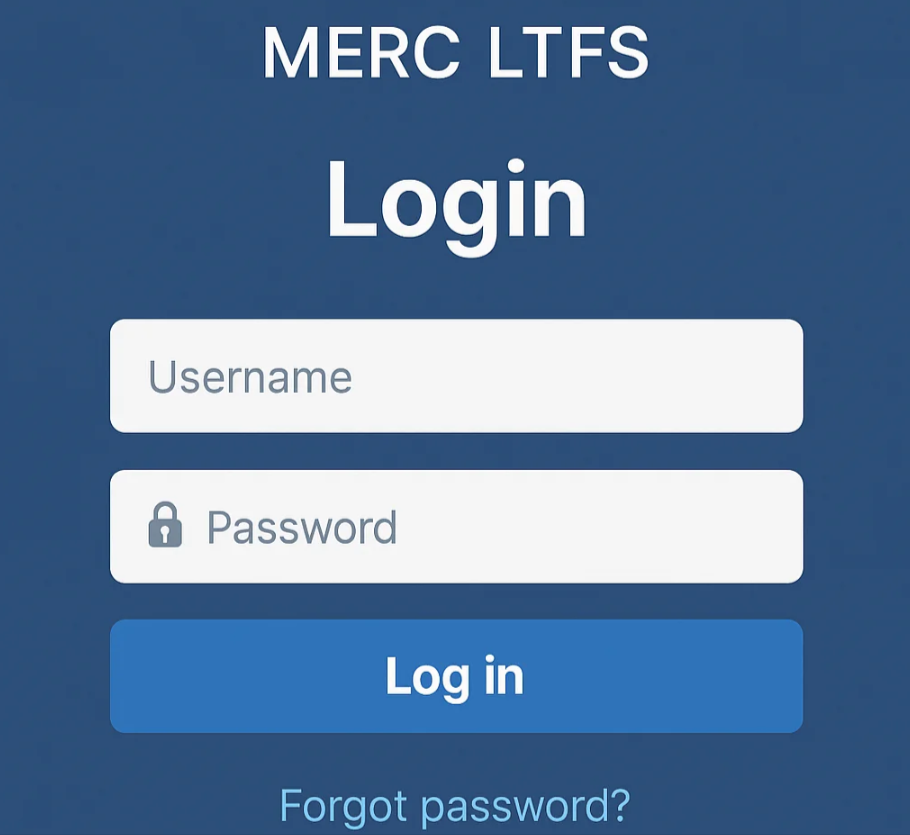

This Merc LTFS Login experience is changing the way people see access to financial and credit tools, specifically for Women entrepreneurs and rural entrepreneurs in under-served communities. With the support provided by L&T Finance, this Microfinance Platform offers services that offer Access to Finance, Inclusive Finance and Financial Inclusion to people as well as small-sized companies that were previously excluded from traditional credit systems.

This guide provides the essential features offered through Merc LTFS, how the loan Application procedure works as well as the advantages from the service, along with the part it plays in assisting women’s economic empowerment and growth. Focusing on the real-world aspects such as Eligibility Check, minimal Documentation and Loan Disbursement you’ll be able to see an understanding of the way it works. Digital Platform supports financial goals in a step-by-step manner.

What is Merc LTFS? Overview of L&T Micro-Finance

Merc LTF is an Digital Microfinance platform designed in partnership with L&T Finance that aims to provide financial services accessible for small and large businesses as well as individuals. In contrast to traditional banking systems, LTFS Merc uses a User-Friendly Interface and Digital Financial Services to simplify the borrowing process, decrease paperwork, and provide easy ways to access financial support. The platform is designed to function as an Lending Platform that allows rural entrepreneurs, women and those who are less well-off are able to connect with lenders through Technology Solutions such as Data Analytics and Machine Learning for Creditworthiness Check.

Its Microfinance Platform supports a broad spectrum of financial requirements such as the need for Micro Loans, Personal Loans, House Finance, and other customized solutions. Through removing the barriers to typical lending Merc LTFS expands Microfinance access to communities that do not have formal credit. With Digital Lending and tech-enabled Loans, borrowers get easy access to not only financial products but also tools to aid in financial management, planning, and long-term stability of the economy.

Vision and Mission of Merc LTFS Login

The goal that is the goal of Merc LTFS is to create an environment for lending that encourages Inclusive Growth by removing traditional obstacles to financial assistance. The focus of the mission is helping people feel comfortable making loans applications, gaining financial resources, and achieving their financial goals using an Transparent Process. In focusing on Women Borrowers and Rural Communities The platform displays an intentional focus on women’s empowerment, rural Development and Social Impact.

Merc LTFS Login is more than just a means of accessing credit. It’s a Lending Process that focuses on transparency, simplicity Lending and the support of the borrower at every stage, from the point of eligibility for loans to loan disbursement and beyond. This goal is in line with larger efforts to broaden Financial Inclusion across segments that are not well-served and frequently not covered by mainstream credit.

The Role of L&T Finance in Micro-Finance

L&T Finance plays a central part in promoting Inclusive Finance through its L&T Microfinance initiatives. Being a part belonging to the L&T Group, it brings expertise in the field of growing financial services as well as integrating new technologies into the credit system. This helps to make Small Business Loans into practical tools for expansion.

Through the combination of Digital Platform capabilities with strategic partnerships and Capacity Building initiatives, L&T Finance has strengthened the Lending Platform under Merc LTFS. The platform can help improve Borrower Confidence by providing Affordable Finance and Loan Guidelines which are simple to follow, as well as Field Verification which respects the borrower’s time.

Through a consistent community engagement and the visibility of Rural Lending, L&T Finance creates trust between borrowers as well as lenders, thereby creating more possibilities to Business Expansion, Economic Opportunities as well as Financial Resources in areas where traditional lending systems are not as effective.

Benefits of Merc LTFS for Borrowers and Businesses

Merc LTFS delivers meaningful benefits for individuals who need loans and those managing portfolios of lending. For the borrower this platform can provide accessible loans with no barriers like minimal documentation and a Creditworthiness check that utilizes advanced techniques such as Alternative Data. The result is that applicants with less credit histories can still be eligible for assistance.

For lenders and business, LTFS Merc provides efficient Loan Processing and Lender Management tools that help monitor loan performance and decrease the risk. Through the use of Tech-Driven Insights and Data Analytics The platform will assist lenders in making more informed choices while offering Borrower support that helps build trust in the long run. Merc LTF acts as an intermediary between lenders who are looking for Investment Opportunities and borrowers in need of financial assistance.

The benefits go beyond fast accessibility to credit. The borrower can gain access to the development of Financial Plan, Financial Literacy and sustainable income, which lay the foundations for better financial stability for families and communities. This method aligns financial support with long-term, professional and personal objectives.

How Merc LTFS Empowers Women Financially

The purpose for Merc LTFS is to provide women with a long-lasting accessibility to tools for financial management that foster financial independence, participation in the economy, and leadership within both community and business. With a focus on female borrowers this platform creates spaces where women can be empowered by clear financial paths. A combination of financial assistance and Empowerment Programs provides advantages that are strategic and can impact the entire household as well as Community Development.

Economic Empowerment

Economic empowerment via Merc the LTFS allows women to take on business ownership, increase earnings sources and make investments into the future. Women who are financially empowered tend to take decisions that improve their family’s health as well as their education and overall wellbeing. With access to low-interest Loans and customized Loans women can begin or expand their businesses, get access to Business Loans and take on leading roles on the local marketplace. This economic organization improves confidence and assists many women get a better footing in the area of financial planning.

Community Development

When women take on the role of leaders in their businesses family, community, and business activities, the positive results extend beyond the individual household. The community engagement increases as women are able to invest their income in local need, schools, as well as community services. Through assisting women’s progress through loan programs such as Merc the LTFS local economies are made more resilient and social networks are more tolerant and connected.

Sustainability & Long-Term Growth

Programs such as Merc LTF help to ensure stability across time. If women are successful in their business ventures they generate more jobs as well as generate repeat business and help strengthen local industries. They contribute to greater Economic Growth and Social Development and increase the importance of inclusive finance to have long-term impact.

Products and Services Offered by Merc LTFS

Merc LTFS offers a wide array of financial services specifically designed to meet the needs of a wide range of customers. When a borrower needs assistance for home, business capital or personal expenses, or even equipment, the platform offers solutions that can meet these needs. Every product is customized to meet the specific needs of a particular financial situation and improve access to the platform in ways that work for every business or individual.

House Finance

The House Finance program under Merc LTF provides loan borrowers with assistance to build, purchase or renovating a home. These loans assist families in gaining security and stability, as well as a space they can be proud to call their home.

Personal Loans

Personal Loans offered through the Loan Portal allow borrowers to take care of emergency expenses such as health expenses, medical bills or family demands without anxiety. The loans are easily accessible and provide the financial flexibility needed when unexpected expenses occur.

Two-Wheeler Finance by Miflow LTFS

Two-Wheeler Financing gives customers the opportunity to have secure transportation, which could increase mobility, expand possibilities for employment, and allow greater accessibility to the services.

Farm Equipment Finance

Farm Equipment Finance supports farmers who are looking to invest in equipment that will enhance yields on their crops, cut down on manual labor and boost income. These loans improve the productivity of rural families and strengthen rural economies.

SME Loans

SME Loans through Merc LTFS help to support Small Business Loans that expand operations, purchase inventory, or even hire employees. These loans assist entrepreneurs scale up their activities which contribute to the local economy.

Rural Business Finance

Rural Business Finance focuses on aiding Rural Entrepreneurs with loans designed to address the needs of small businesses in rural areas that aren’t well-served. These loans can help to expand local markets as well as strengthen the community-based enterprises.

Insurance Products

Merc LTFS also offers important insurance products to help safeguard the financial future of borrowers as well as their well-being.

Life Insurance

Life Insurance gives families protection and security in the event of a sudden loss, helping to pay their bills and meet longer-term needs while maintaining stability.

Health Insurance

Health Insurance helps cover medical costs, while reducing stress on families and individuals when faced with medical emergency.

General Insurance

General Insurance protects personal assets from loss or damage like property or vehicles by securing money and maintaining financial stability.